How do I complete a New Application Form?

Create a SUSI Account

Applications for student grant funding can be made by visiting www.susi.ie and clicking on the “Login" button at the top of the page.

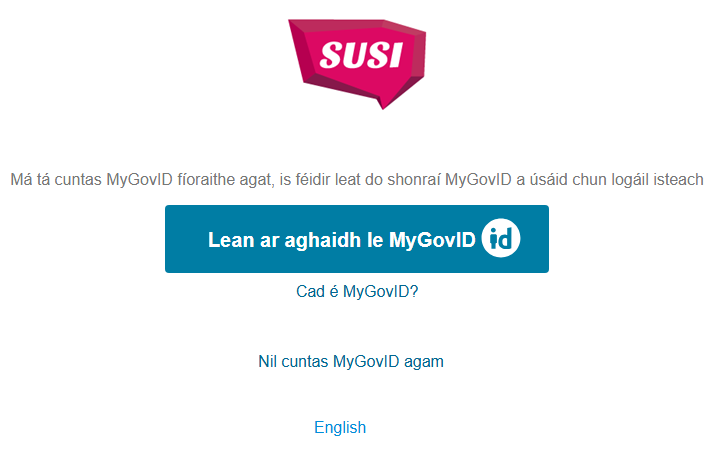

Create a SUSI Account or Log in with your MyGovID

You can register for a SUSI account or use your verified MyGovID. To create a SUSI account select “I don't have a SUSI account yet”.

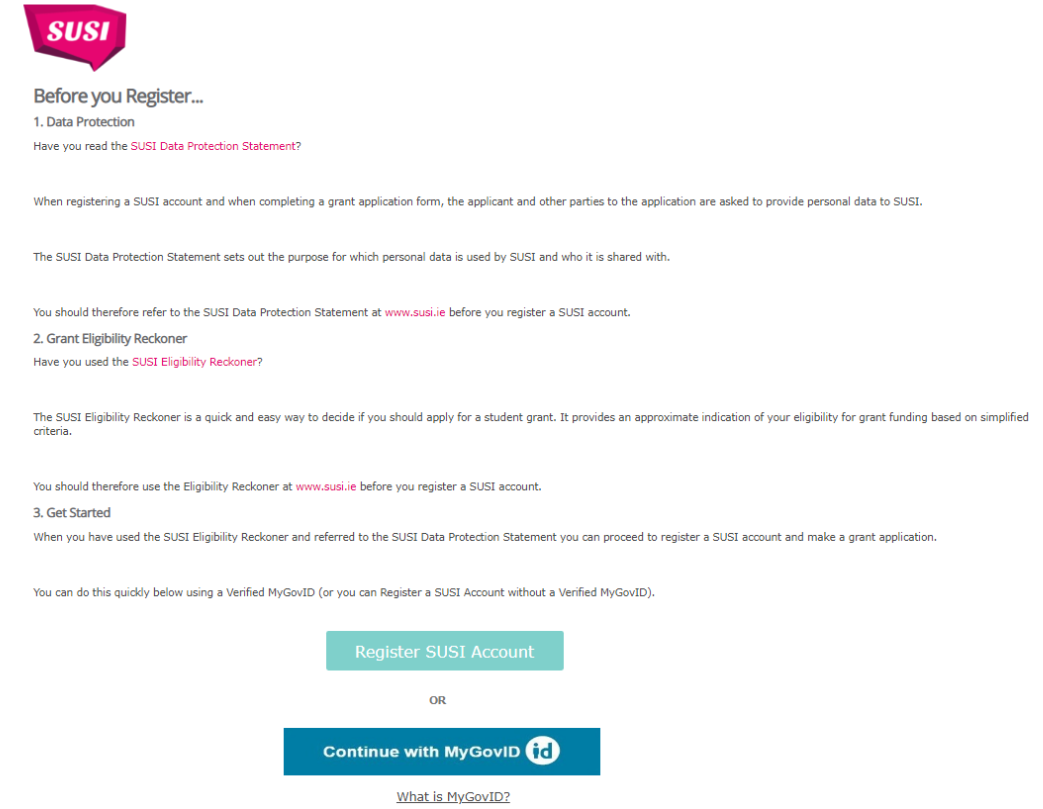

You should read SUSI's Data Protection Statement before proceeding. On this page you also have the option to complete the Eligibility Indicator by clicking on the relevant link. This will give you an indication of your eligibility for grant funding. After you have read the SUSI Data Protection Statement and completed the Eligibility Indicator, you should select the "Register SUSI Account" button as shown in the screen-shot below.

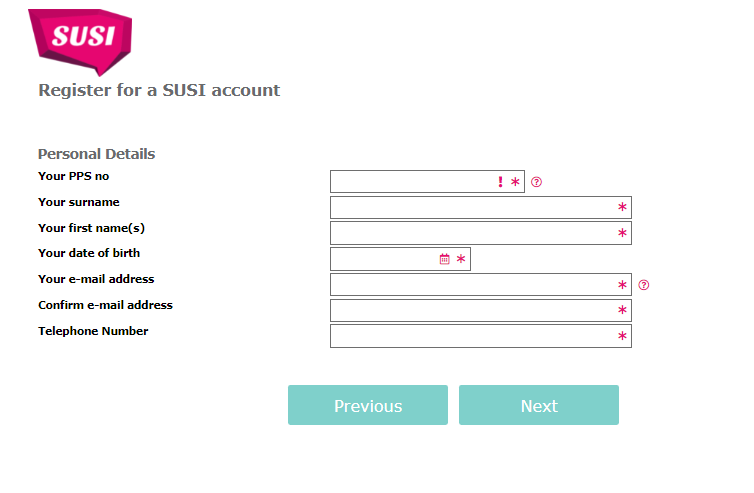

You will be required to enter your Personal Public Service Number (PPSN). If you do not have a PPSN, please apply for one by contacting Client Identity Services in the Department of Social Protection. Your registration cannot be completed without this information. You will also enter your name, date of birth, email address and phone number. Once you've completed this page, select “Next”.

You will be advised that an email has been sent to the email address you have entered containing a seven digit verification code and to please enter the verification code in the box provided. You have 20 minutes to enter the code before it expires.

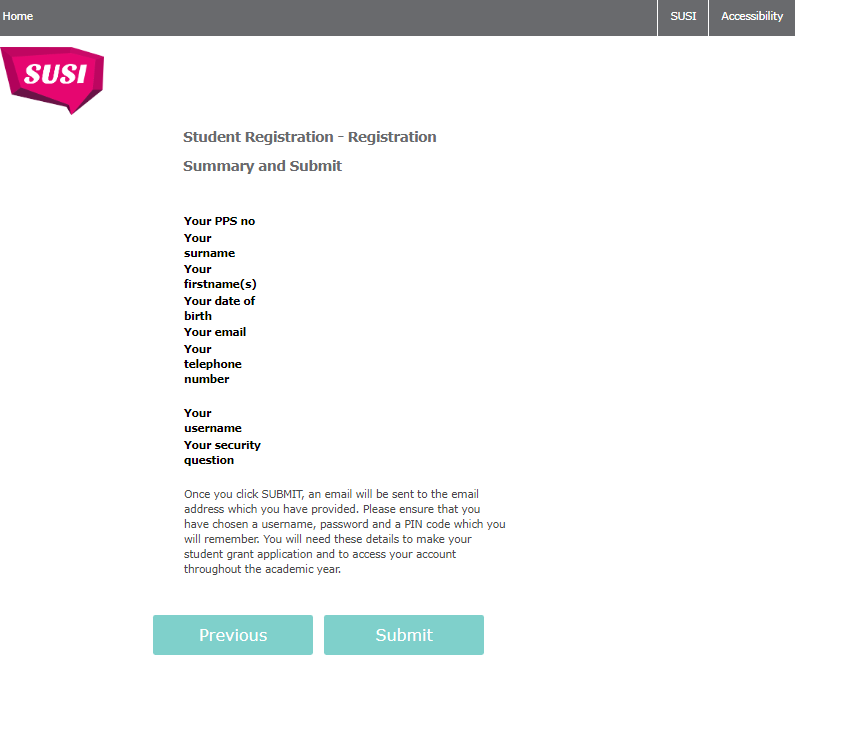

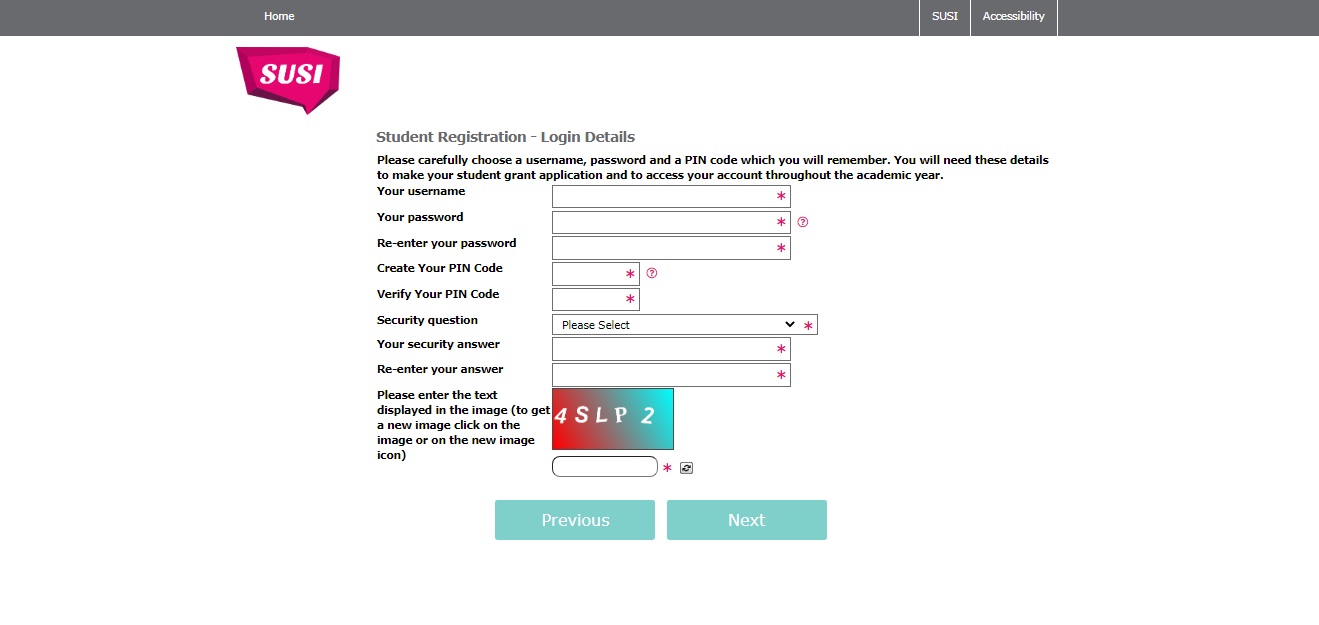

- Please ensure that both your username and password are easy for you to remember as these will be needed on an ongoing basis to allow you access your account and information about your application.

- Choose a 6 digit Pin Code. This must contain 6 numeric digits and should not be something which can be easily associated with you such as your date of birth or your phone Some obvious PIN Codes (e.g.123456) also cannot be selected.

- Select a security question and provide an answer. This information will assist in the event that you forget your password and need to reset it.

- Retype the security code displayed in an image box at the bottom of the screen

- When these fields are completed, select “Next"

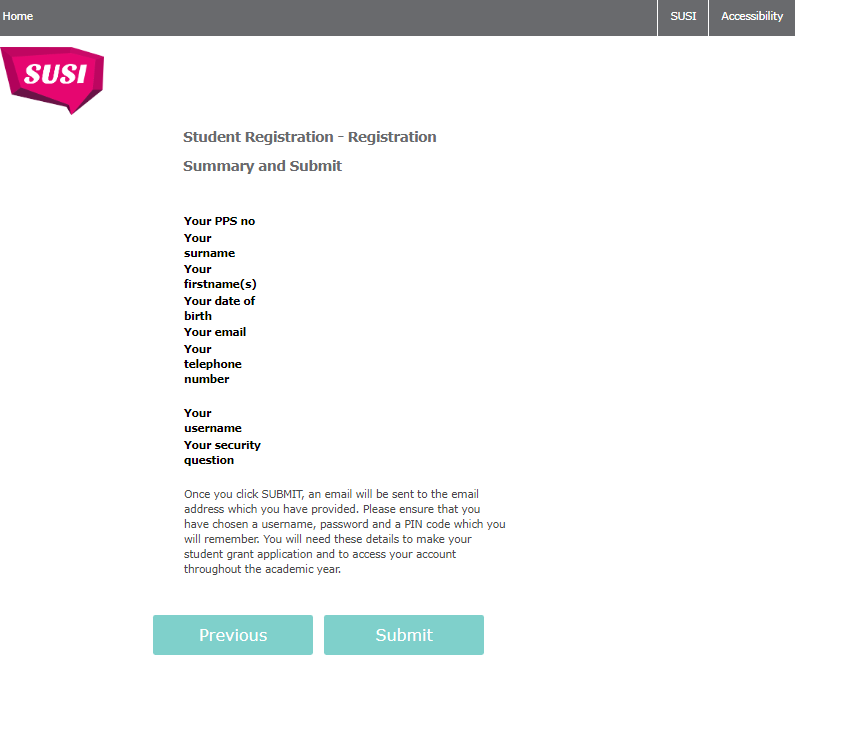

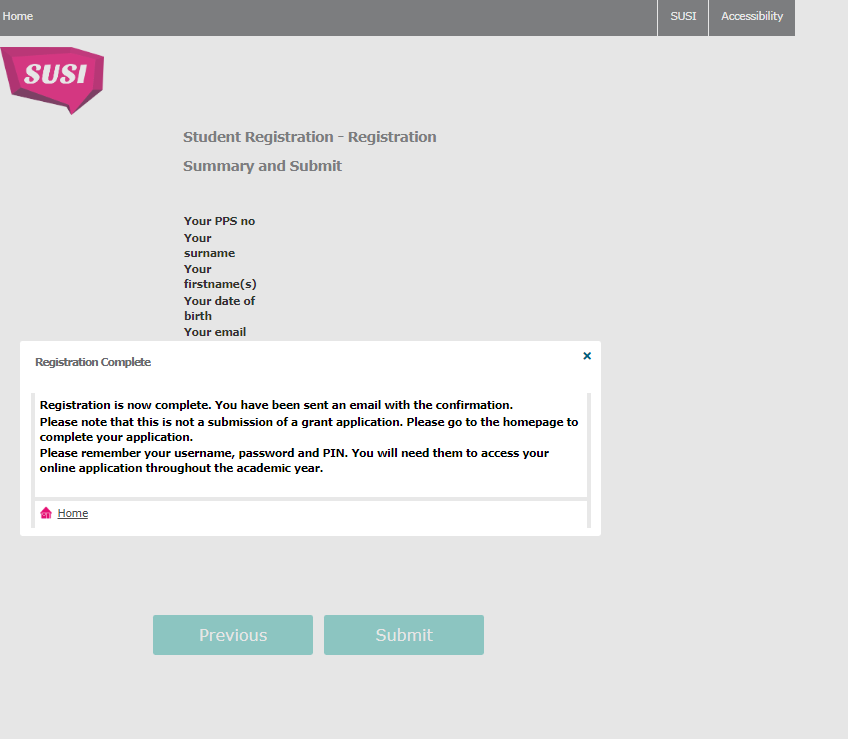

A summary of your registration will appear and if all is in order, click ‘Submit’ button to activate your online account. These account details can be used by you for subsequent grant applications in the future or to renew your grant from year to year.

It is recommended that you read the SUSI website (www.susi.ie) to review the information on Eligibility Criteria before filling in the application form.

When you are ready to start filling in the application form, you should have the following information to hand:

- Your 8 digit CAO number. If you have ticked the SUSI box on your CAO Form, this will allow SUSI to retrieve direct notification about your chosen course.

- Your 10 digit UCAS number, if you applied through the UK application system.

- PPS numbers for yourself, your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable.

- Income details for 2025 for yourself (if any), your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable.

The application form comprises the following sections:

- Applicant's Personal Details

- Applicant's Nationality & Residency

- Applicant's course details, previous education and other sources of financial assistance

- Dependent Children and Relevant Persons

- Income details of parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable

Please ensure that you, your parent(s)/legal guardian(s), spouse ,civil partner or cohabitant, as applicable, complete all the relevant sections of the application form.

If you, your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable, provide information that is false or misleading, you or they may be guilty of an offence and liable to prosecution leading to a fine, a prison term or both, under Section 23 of the Student Support Act 2011.

When you have completed the application form, it is important to read and confirm the Data Protection Statement before submitting your application.

If you become aware that any of the information you have submitted is incorrect or has changed, you must inform SUSI immediately by emailing support@susi.ie. You must also inform SUSI if there is a change in your circumstances that may affect your eligibility for a grant or your rate of grant, if awarded.

These guidance notes are not a legal interpretation. You should refer to the provisions of the Student Support Act 2011, Student Support Regulations (Current Year) and Student Grant Scheme (Current Year) for complete and detailed information on student grants.

- To make an application, you must have either created an online account as outlined in Step 1 or have logged in with your verified MyGovID.

- You can access your account by visiting susi.ie and clicking on “Login/Apply”on the homepage.

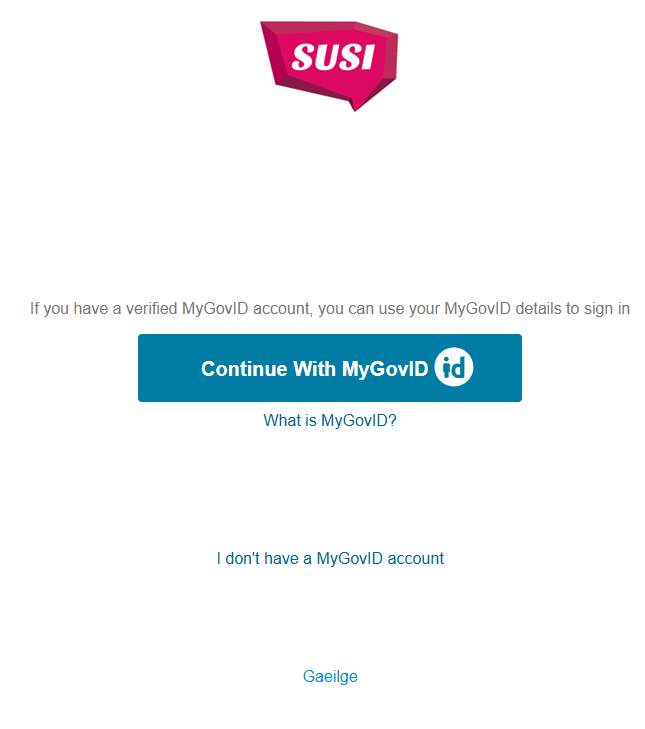

- You will reach a page, as shown above, where you will need to enter your Username, Password and PIN Code you used when registering your account or you may log in using your “MyGovID”

- If you are unable to remember your Password or PIN Code, you should follow the instructions in the "I forgot my SUSI Password/PIN Code links on the login page.

- Once you have entered the requested information, click the login button.

Your SUSI Account Portal

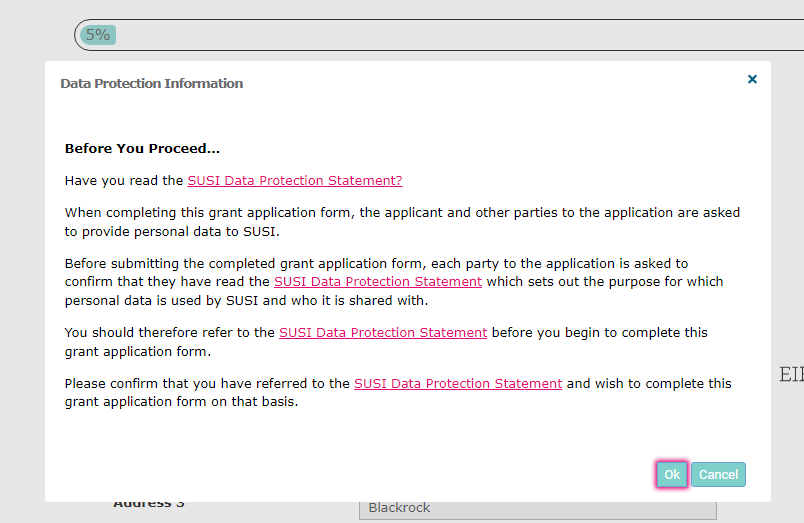

After log in you must first confirm that you have read the data protection statement.

You will then navigate to the below page where you can:

- view the percentage of your application that's completed,

- update your personal details,

- enter bank account details (when requested),

- submit a Course Change Notification if requested.

To begin your application, click the “Start Application” button.

At the top of each page of the online application form you will see a progress bar which indicates the percentage of your application that has been completed and the section of the application you are currently completing.

You do not have to complete your application in one sitting. If you need to take a break or gather relevant information that is being requested, you can end the session and not lose any information already supplied. You can resume your application by logging into your account and selecting the “Edit Application” button.

What information is being requested?

Most of the information being requested in this section relates to your own personal details, i.e. PPSN, name, contact details, marital status, etc.

You can also click the ? symbol for further clarification on a particular question.

Before you proceed with your application, you should read the SUSI Data Protection Statement. If you have read this and wish to proceed with making an application you should select OK

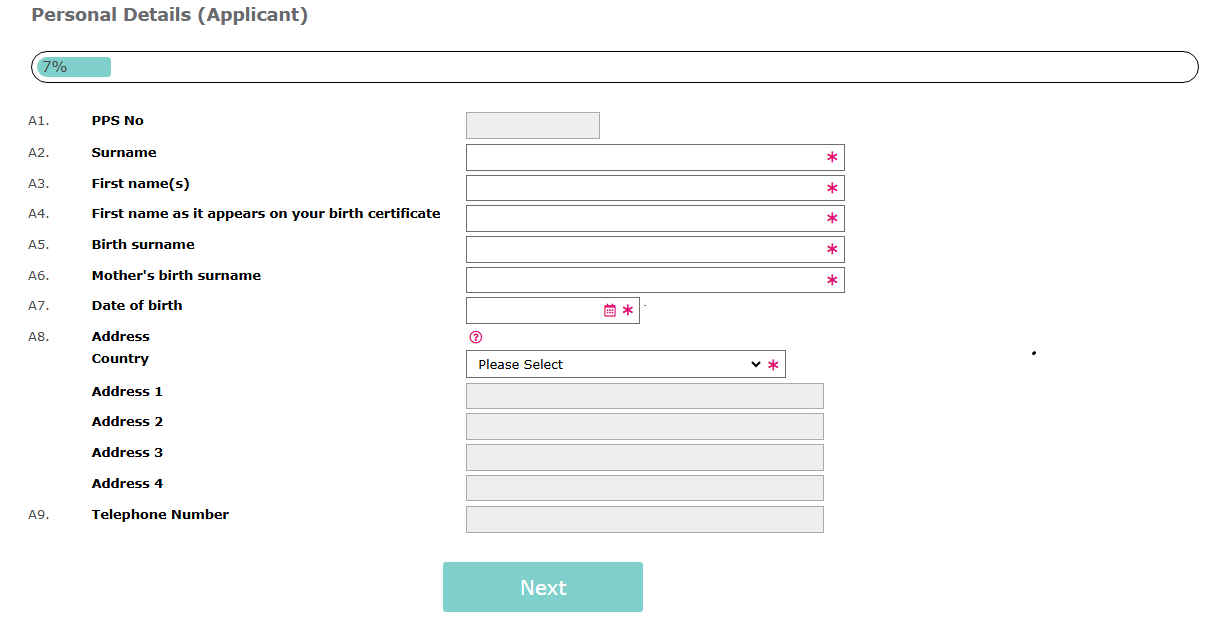

Your Personal details (Part One)

A1. Your PPSN. Please check the accuracy of the PPSN entered. If your PPSN number is entered incorrectly, your application may be delayed.

A2. Your surname.

A3. Your first name(s).

A4. Your first name as it appears on your birth certificate: After provisional assessment of your application, you may be asked to provide a copy of your birth certificate as documentary evidence. If you are an Irish citizen, this should be a copy of your long form birth certificate.

A5. Your birth surname as it appears on your birth certificate.

A6. Your mother’s birth surname.

A7. Your date of birth (dd/mm/yyyy).

A8. Your address: This is the address at which you ordinarily reside at and not the address where you live while attending college. You may be asked to provide evidence of your address in order to assess your application.

If you know the Eircode for your home address, you can enter it here. If you do not know the Eircode, you can start to type the first line of your address (including the house/apartment number if applicable) and then select your address from the available options. If no matches are found, you can locate the Eircode for your home address using Eircode Finders by clicking on the icon.

If your address has not been assigned an Eircode, you can tick this box.

A9. Your contact details: Home and mobile telephone details

A10. Your email address: Details of your current email address for correspondence.

A11. Do you have a CAO or UCAS number?

If you have applied for a higher education course through the Central Applications Office (CAO), please enter your 8-digit CAO number. This will allow us receive direct notification about your chosen course, if you have authorised CAO to share this information with us.

If you have applied for a higher education course in the UK through UCAS, the UK application system, please enter your 10-digit UCAS number.

If you have not applied through CAO or UCAS, please choose the ‘No’ option.

A12. Class of Applicant:

It is important for you to establish which class of applicant you are as this will determine whose income we take into consideration and who should fill in each section of the application.

Applicants are categorised into the following classes of student:

Dependent student which is broken down into the following two types:

- Student dependent on parent(s) or legal guardian(s)

- Mature student dependent on parent(s) or legal guardian(s)

Independent student

- Mature student who does not ordinarily reside with his/her parents, or either of them.

A13. Your marital status. Please select from the drop down menu.

A14. Which category would best describe you. For example, student, employed, retired. Please select from the drop down menu.

A15. Have you applied for or will you be getting a Back to Education Allowance (BTEA) payments for the 2026/27 year?

You should select ‘Yes’ if you have applied for or expect to be in receipt of BTEA for the 2026/27 academic year. Please note that if you are in receipt of such payment, you may not be eligible to receive a maintenance grant from SUSI.

A16. Have you applied for or will you be getting a Vocational Training Opportunities Scheme (VTOS) payments for the 2026/27 year?

You should select ‘Yes’ if you have applied for or expect to be in receipt of VTOS for the 2026/27 academic year. Please note that if you are in receipt of such payment, you may not be eligible to receive a maintenance grant from SUSI.

Having completed all of your Personal Details, you will be presented with a summary of the information you have provided, which you can amend if necessary. If the information is correct, tick the box and click ‘OK’.

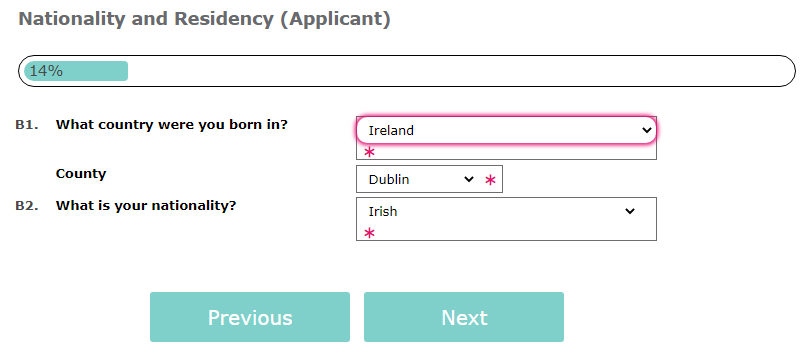

The information being requested in this section relates to your own nationality and residency status, two of the main criteria which will determine whether or not you may be eligible to receive grant funding.

You can also click the ? symbol to clarify a particular question.

B1. What country were you born in?

Select the country in which you were born, which may be different from your nationality.

B2. What is your Nationality?

Select your nationality.

If you select a nationality other than EU, EEA, UK or Swiss National, question B3 will appear.

B3. If you are not an EU, EEA, UK or Swiss national, on what basis are you staying in Ireland?

Please enter your Garda National Immigration Bureau (GNIB)/Irish Residency Permit (IRP) reference number and select the option (a-h) which applies to you. Please also enter the date on which your permission to stay in Ireland was granted.

After your application is provisionally assessed, you may be asked to provide proof of your nationality,

- a copy of your passport, GNIB/IRP card, identity card

- relevant correspondence from the Department of Justice.

B4. Have you been resident in Ireland for at least 3 of the last 5 years?

To be eligible for a fee grant and a maintenance grant, if applicable, you must have been resident in Ireland for at least 3 of the 5 years prior to the year in which your course commences. If you answer ‘No’, question B5 will appear as shown here.

B5.Have you been resident in the EU, EEA, UK or Switzerland for 3 of the last 5 years?

If you were not resident in Ireland for 3 of the 5 years prior to the year in which your course commences, but have been resident in another EU Member State, the EEA, the UK or Switzerland for at least 3 of the last 5 years prior to the year in which your course commences, you are known as a tuition student. Tuition students may be eligible for a fee grant only.

If applicable, please use the table provided, (shown above) to give details of where you were resident during the requisite period. If the reason that you were temporarily resident outside of Ireland was because you were pursuing an approved course of study or postgraduate research in the EU, then you may still be eligible for a student grant.

If you answer ‘No’ to both question B4 and B5 you will not meet the residency requirements for grant funding, as set out in the Student Support Act 2011 and, as such, you will be unable to proceed with your grant application and you will see the following pop-up box.

Having completed this section, you will be presented with a summary of the information you have provided, which you can amend if necessary. If the information is correct, tick the box and click “OK”.

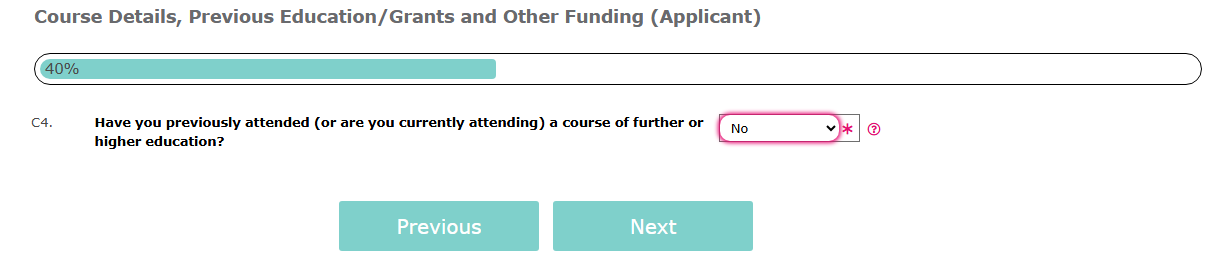

The information being requested in this section relates to your education history, the course you wish to pursue in the coming academic year and any financial assistance you may be receiving.

Please note: Depending on your previous education details and the course you intend to pursue, you may receive a pop up warning that you are not eligible due to the maximum periods of study being exceeded.

You can also click the ? symbol to further clarify a particular question.

C1. Have you completed your Leaving Certificate or equivalent final school exam? Equivalent refers to ‘A’ Levels, Baccalauréat, etc.

C2. What is the highest level of qualification that you have attained in further or higher education on the National Framework of Qualifications (NFQ) or equivalent? Please select the relevant level from the drop-down list.

C3. Initial assessment of your eligibility for a grant will be based on the course details that you provide below. You should answer all questions about your chosen course even if you have not yet been offered or accepted a place (i.e. if you have applied or intend to apply for a course).

Please note that you do not need to have accepted a place on a course to complete this application for grant funding. CAO applicants should enter their first choice course. Drop down menus will appear for all institutions listed in Ireland and Northern Ireland. For all other institutions, please select the country.

If you are pursuing a Tertiary Education Programme, choose the level of the award you will receive on completion of the course in the dropdown for the first question in C3. When entering in the Institution Name, choose the local education and training board centre where you will begin your course.

If you answer ‘yes’ to the question ‘Is this a repeat year?’ You will then see the following question: ‘Are you repeating this year due to exceptional circumstances?’ You should answer yes to this question if exceptional circumstances apply to you. You will be contacted directly by the Exceptional Circumstance Team in relation to your application.

C4. Have you previously attended (or are currently attending) a course of further /higher education? Please provide details of all further and higher education courses you have previously attended, including courses that you did not complete or where you did not gain a qualification. If you withdrew from any such courses, it is very important that you state the specific date of withdrawal.

C5. Question C5 is no longer valid and has been removed from the application form.

C6. Do you hold or have you ever held a student grant?

If you answer yes to this question, please complete the relevant sections giving details.

C7. Have you applied for or will you be getting any other student financial assistance from Ireland or abroad for the 2026/27 academic year?-

Please advise if you have applied for, been offered or will be in receipt of student financial assistance from any other source at any time during the upcoming academic year 2026/27. Examples of financial assistance include scholarships, bursaries, prizes or other student grants from Ireland or abroad.

Having completed this section, you will be presented with a summary of the information you have provided, which you can amend if necessary. If the information is correct, tick the box and click ‘Ok’.

The information being requested in this section relates to children and relevant persons. A relevant person is another person (dependent child, applicant’s parent(s)/legal guardian(s), independent applicant’s spouse, civil partner or cohabitant) within the household who is attending a full-time course of study in further or higher education or an approved part-time course. Each such person will be taken into account by way of an additional increment to income limits when calculating ‘Reckonable Income’.

You can also click the ? symbol to further clarify a particular question.

E1. Dependent Children

In assessing your application, the number of dependent children in your household may affect the reckonable income limits calculated for your household.

A dependent child means a child, including a foster child, who on 1 October 2025 was one of the following:

- Aged under 16 years of age

- Aged 16 years or more and pursuing a full-time course of education

- Aged 16 years or more and is certified as being permanently unfit to work by reason of a medical condition.

You should select the number of dependent children as above and click the ‘Next’ button. If you have selected more than ‘3’ for this amount, you will see a menu where you can enter the relevant details by selecting the ‘Action’ option as shown above.

E2. Relevant Persons

In assessing your application, the number of “relevant persons” (other than the applicant) in your household who are attending full-time further or higher education or an approved part-time course may increase the reckonable income limits calculated for your household and therefore increase the amount of any grant awarded.

Please advise details of all relevant persons so that your reckonable income can be calculated accurately.

By selecting the box of a relevant person, you have agreed to share your data, for the purpose of cross- referencing and processing the application for that relevant person, should they apply to SUSI for a student grant.

The application data of relevant persons will not be used for the processing of your application unless they select you in Section E2 of their application form.

“Relevant Persons” as detailed above, can be added to your application by selecting the action option and the above screen will appear. You should enter the ‘relevant person(s)’ details (if applicable), confirm you wish SUSI to cross reference your application to the relevant person and click ‘Ok’.

Having completed this section, you will be presented with a summary of the information you have provided, which you can amend if necessary. If the information is correct, tick the box and click ‘Ok’.

Section F collects information on the total reckonable income relevant to the application.

If you described yourself as an “Independent Student” in question A14 (Class of Applicant) and you are not married, in a civil partnership or cohabiting, you, the applicant, should complete this section where applicable.

If you described yourself as an “Independent Student” in question A14 (Class of Applicant) and you are married, in a civil partnership or cohabiting, you, the applicant, and your spouse, civil partner or cohabitant should complete the relevant sections.

If you described yourself as a “Student dependent on parent(s)/legal guardian(s)” or a “Mature student dependent on parent(s)/legal guardian(s),” you, the applicant, and your parent(s)/legal guardian(s) as applicable, should complete the relevant sections.

Please note:

You, the applicant, will share your income details in the first part of section F. Once completed, relevant other parties to the application will be prompted to complete their personal and income details.

The questions for the applicant and the other parties to the application are the same so the following notes are relevant for all.

You must read this checklist and indicate that you have done so before proceeding with this section.

F1. Were you employed in 2025 on a full-time, part-time or temporary basis?

If you, your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable, were employed at any time in 2025, whether on a full-time, part-time or temporary basis, you must give us the total gross income earned in 2025, including any benefits-in-kind, from all Irish and foreign employments. If you had foreign income, you must enter the Euro equivalent.

Do not enter income earned from self-employment here. Question F4 is dedicated to self-employment.

Income earned while participating on a Community Employment (CE) Scheme is one of the designated programmes for eligibility for the Special Rate of student grant. We include benefits-in-kind at their figure for income tax purposes.

We allow the same deduction from income for expenses directly related to employment (flat rate expenses) as set out in your Statement of Liability (formerly P21) for 2025.

Applicant’s earnings from holiday employment:

The applicant must include any income for 2025 in this section. A deduction will be allowed for reasonable holiday earnings (up to a maximum of €8,830) which is income earned by the applicant from employment outside of term time.

F2. Did you receive any social welfare payments in 2025 other than child benefit?

If ‘Yes’, please select the relevant payment from the list provided on screen (e.g. rent allowance, foster care allowance, etc.), provide the weekly rate of that payment and the number of weeks you were in receipt of that payment. A calculation of the total amount of each payment will be automatically made on screen, depending on the rate and number of weeks entered, and a combined total given.

F3. Did you receive a payment from any other government department or state agency?

If ‘Yes’, please select the appropriate payment from the list provided on screen (e.g. HSE, SOLAS or a Local Authority), provide the weekly rate of that payment and the number of weeks you were in receipt of that payment. A calculation of the total amount of each payment will be made automatically on screen, depending on the rate and number of weeks entered, and a combined total given.

F4. Were you self-employed or engaged in farming in 2025?

If you were self-employed or engaged in farming during 2025, please provide details of all income earned or losses incurred from said employment. If your business year differs from the tax year, the relevant income will be that which appears in your business accounts for a year which ends at some point between 1 January and 31 December 2025.

If you answer "Yes" to questions F4, a "Self-employed Add Backs" table will appear for completion. You will have to complete this and press "Ok" before proceeding. You should enter estimates if you do not have your accounts ready and the figures will be confirmed through our links with the Revenue Commissioners and documentation requested.

F5. Did you have rental income from any of your land or properties in Ireland or abroad in 2025?

If you had rental or other income from land and properties in Ireland or abroad at any time during 2025, please provide details of all income earned or losses incurred from the rental of said properties. If you answer "Yes" to question F5, a "Rental Income Add Backs" table will appear for completion.

F6. Were you a proprietary director or shareholder of a limited company in 2025?

Where any part of your income for 2024 was paid by a limited company of which you were a proprietary director or in which you had a significant equity shareholding, please choose the "Yes" option here and enter details of said income, including benefits-in-kind, at F1 above.

F7. Did you receive a pension other than a Social Welfare State Pension in 2025?

If ‘Yes’, please state the total gross amount of said pension. If you, your parent(s), legal guardian, spouse, civil partner or cohabitant, as applicable, have income from pensions other than the contributory and non- contributory Social Welfare State Pension, please provide details.

F8. Did you have any income in 2025 from savings, deposit accounts or investments?

If you, your parent(s, legal guardian, spouse, civil partner or cohabitant, as applicable, have money or investments in a financial institution or elsewhere, enter the gross amount of all interest or income earned from savings, deposit accounts, personal loans made by you and investments (stocks, shares, bonds, securities and dividends in 2025. Investments include: savings certificates, life assurance bonds or other financial instruments. Where the interest or profit builds up and is paid out as a lump sum at the end of the investment period we only take a proportion of this amount.

For distributions from Irish companies, you should include the amount received and the Irish tax deducted. For foreign interest and dividends, you should include the euro equivalent of the gross amount earned before deduction of foreign tax, if any.

F9. Did you have any income in 2025 from a maintenance agreement?

If ‘Yes’, please enter the amount to include monies received as maintenance and any other payment made to a third party as part of a maintenance obligation, e.g. rent, mortgage payments, loan repayments, insurance and life assurance, upkeep of home, repairs and renewals, medical, education, etc.

F10. Did you receive a lump sum payment during 2025 from retirement or redundancy?

If you, your parent(s, legal guardian, spouse, civil partner or cohabitant as applicable, received a lump sum payment in 2025 arising from retirement or cessation of employment (including redundancy), please provide details here.

Retirement: Where you, your parent(s, legal guardian, spouse, civil partner or cohabitant, as applicable retired in 2025 from employment or self-employment and received a lump sum, we take a proportion of the lump sum into account for calculating reckonable income for student grant purposes. We calculate the proportion we take into account by dividing the retirement lump sum by the number of years of pensionable service. If you are self-employed, the 'pensionable service' you should enter is the number of years for which you made contributions to a retirement product.

Redundancy: If you, your parent(s, legal guardian, spouse, civil partner or cohabitant as applicable, ceased employment or were made Redundant in 2025 and received a lump sum, we take a proportion of the lump sum into account for calculating reckonable income for student grant purposes. We calculate the proportion we take into account by dividing the lump sum by the number of years of service with the employer.

F11. Did you have any income in 2025 from disposal of assets or rights?

If ‘Yes’, please include details of all gains and losses on the "Disposal of Assets and Rights" table which will appear at the end of the application form. Any losses arising from the disposal of an asset can be offset against all other sources of income in the reference period. Only a portion of any gain will be taken into account when calculating reckonable income.

F12. Did you receive any gifts or inheritances in 2025?

If you, your parent(s), legal guardian, spouse, civil partner or cohabitant, as applicable, received gifts or inheritances in 2025, you must complete the "Gifts and Inheritances" table. This table will appear automatically for completion before you submit your application. Please provide details of all gifts and inheritances even if you did not have to report them to the Revenue Commissioners for Capital Acquisitions Tax purposes. The only exceptions are:

- In the case of an independent student, gifts and inheritances between the applicant and his or her spouse, civil partner or cohabitant

- In the case of all other applicants: gifts and inheritances between parent(s) or legal guardian and gifts and inheritances to the applicant from his or her parent(s) or legal guardian

F13. Did you receive any other income such as foreign income, Scholarships, Bursaries or any other funding from sources not mentioned above?

If you answer "Yes’" to F13a Please select from the selection in the pop-up box (see list below). If you answer "Yes" to F13b Please use the text box to describe the source and the income box for the amount.

If you answer "Yes" to F13c Please complete the "Woodlands" table at the end of the application form. This is any income received from the sale of woodlands from 1 January to 31 December 2025. This includes income from private sales or income from the Department of Agriculture, Farming and Marine or equivalent body in or outside the State.

F13(a) Scholarship & Bursary

Income from Scholarships/Bursaries – This is any income, both maintenance and/or fees, received from Scholarships or Bursaries from 1 January to 31 December 2025. The SUSI grant, Student Assistance Fund, TAP, HEAR and DARE should not be included. If not listed here, please use "Other" option to complete.

Examples of types of Scholarships/Bursaries that should be included are

- Awards such as scholarships, prizes or bursaries, made by the institution being attended;

- Postgraduate research awards where the stipend portion of the award does not exceed a specified amount which for the relevant academic year, is specified to be €19,000;

- Department of Education and Skills Third Level Bursary Schemes;

- All Ireland Scholarship

F13(b) Income from Sources not mentioned

This is any other income received from sources that are not mentioned in any previous question from F1 to F12 on the application form, from 1 January to 31 December 2025. This may include foreign income. This is any income earned outside of the State from 1 January to 31 December 2025.

Tax-exempt incomes - artists, woodlands income, patents, rent-a-room relief or childcare services (Note: stallion stud fees and greyhound stud fees were tax exempt but became taxable from 1st of August 2008). If you have income from these activities you should include it in Question F4 - Self- employment or farming.

Settlements, trusts, covenants and estates- In the case of covenants, you do not need to include income you, the applicant, received under a covenant from your parent(s) or legal guardian unless you are an independent student.

Fees, commissions or income of a similar nature, earned outside your main employment or self-employment. Benefits not included on your Employment Detail Summary (formerly P60) or Statement of Liability (formerly P21), for example, employer PRSA contributions and other taxable benefits. The gross value of amounts withdrawn from pension products, other than the tax-free lump sum.

Restrictive covenants. Payments received on commencement of employment. Sums you received after a business ceased trading, for example, debts which were considered uncollectible when the business ceased trading. Gains from prize bonds, lotteries, gambling or sweepstakes. Any other income or benefit not described in Section F.

F14. Did you make a legally enforceable maintenance payment in 2025 following a separation or divorce?

If ‘Yes’, please enter the total gross amount paid. A deduction may be made for maintenance payments to a separated spouse provided there is a legal separation or divorce agreement in place. The amount deductible from reckonable income is the amount that appears on your Revenue Self Assessment Statement or Statement of Liability (formerly P21).

F15. Did you make any pension contributions in 2025? (Do not include public sector pension related deduction or any pension deduction made at source).

We allow a deduction for contributions to pension schemes and pension or retirement products, for example, Personal Retirement Savings Account (PRSA) or Retirement Annuity Contract (RAC), paid in the reference period only, within the limits allowed by the Revenue Commissioners, but we exclude any ‘unrelieved’ contributions carried forward from previous years. We also allow a deduction for the public service pension levy.

Please enter the pension or retirement contributions allowed for income tax purposes for 2025 as shown on your Revenue Self-Assessment Statement or Statement of Liability (formerly P21), after deducting any ‘unrelieved’ contributions from previous years.

F16. Did you have a permanent change in circumstances in relation to reckonable income since 2025. Please provide details of the permanent change in circumstances.

If there is a fall in your income, or that of your parent(s), legal guardian, spouse. civil partner or cohabitant as applicable, between 1st January and the end of the 2026/27 academic year, and that fall in income is likely to continue for the duration of the approved course or the foreseeable future, you may apply for a review of your application where you were previously refused or awarded a part-grant.

If you have not completed a student grant application form for the 2026/27 academic year and your income is now within the specified limits, you can make an application for a student grant under a change in circumstances which will be assessed based on your current income (2026) rather than income in the reference year (2025). However, we will re-assess your application for the 2027/28 academic year. This review will be based on your income in the reference period for the 2027/28 academic year (i.e. 2026)

F16. Additional Information

Please provide any additional notes here that you feel may be of importance in relation to the assessing of your grant application. This free text section should be used to indicate any or all important information pertaining to your application that could not be captured in sections A to F that may be relevant.

For example, parent may be separated and living with partner at the home address. The household depends on financial support from the partner's employment/Department of Social Protection (DSP) payment. Please provide details in section F16.

Another example would be to indicate a permanent Change in Circumstances that may warrant a review on current income as opposed to the income in the reference period of 2025. Perhaps someone in the household was working in 2025 and has since been made redundant in 2026. Please provide details in section F16.

Having completed all of Section F, you will be presented with a summary of the information you have provided, which you can amend if necessary.

After confirming/amending the applicant's income, the personal and income details for all other parties to the application (mother/father/ legal guardian/spouse etc.) must be completed.

The authorisation to provide personal details must then completed.

Once authorisation has been confirmed, the personal details for all other parties (mother/ father/ legal guardian/spouse) to the application must be completed

Income questions F1 to F16 must then be completed for all other parties to the application

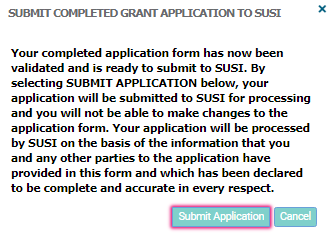

Once each person's details are "complete", you may click the Validate Application button below to take the final steps before submitting the application to SUSI for processing.

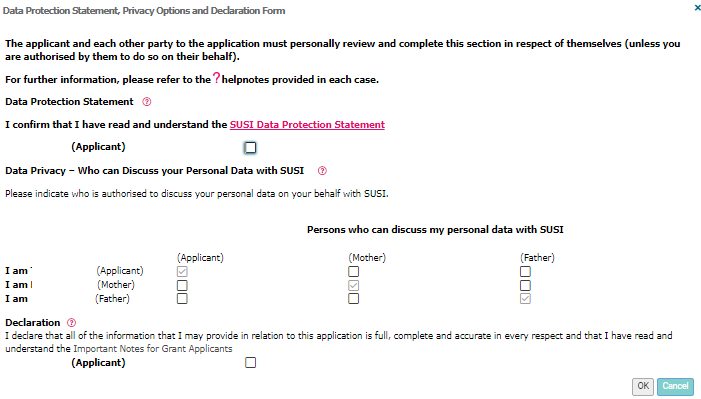

You will be presented with a summary of the SUSI Data Protection Statement, Privacy Options and Declaration Form. You must indicate you have read and agree to the full Data Protection Statement. Each person named on the application form must confirm that they have read and understand the statement.

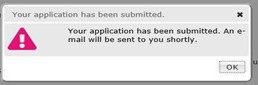

You may now click on the ‘Submit Application’ button. You will now be submitting your application online to SUSI. When you select ‘Ok’your application will be submitted for processing. When submitted you will be able to change your contact details by using the ‘Your Personal Details’ section on the main menu.

Your Application is now submitted

Please note: You will not be able to make changes to any section of the application. Your application will be assessed based on the information you have supplied once you click submit. You will receive confirmation of submission by email to your registered email address.

If you have not received an email confirming your application is successfully submitted within 24 hours, you should contact the SUSI Support Desk.

When you log into your account you should see the following navigation screen which will list your application reference number, type, the date submitted, the submission progress and submission status.

This screen is where you can see the progress of your application under “Submission Status”.

You can also edit details, submit bank details and Course Change Notification Form (if requested) and view details of your payments (if/when you are awarded).

You will be contacted by SUSI through your postal address for the next stage of the application process.